Company Incorporation in United Kingdom

Company Incorporation in United Kingdom |

Primary Requirement for a Private Limited Company in UK

- Atleast 1 Director and shareholder. AOA may authorise for higher min. number.

- No Minimum paid up cpaital 1 GBP. No Maximum cap.

- Shareholder may be resident or non resident. Minimum 1 Shareholder.

- No statutory oblication to appoint Company Secretary

- A Registered Office Address in UK

- Director & Shareholder can be same person

Company Incorporation in United Kingdom

Why United Kingdom is best choice for Business?

The UK is a flexible and business-minded location, historically recognised as a well-established and reputable jurisdiction in which to conduct business. Its open market and diversified economy present opportunities for new investors to access a domestic market and to use the location as a gateway to the rest of the world.

The UK is currently ranked seven among 190 economies worldwide on the World Bank’s ‘Ease of Doing Business’ survey, which said: “The UK is a good place to do business because it is simple and very affordable to start a new business. The tax burden on small and medium size businesses is low and easy to comply with, the process of importing and exporting is straightforward, and commercial courts are very efficient.”

UK company incorporation is governed by the Companies Act 2006 (“the Act”), under which the following types of companies can be set up:

- Private Company Limited By Shares

- Private Company Limited By Guarantee

- Private Unlimited Company

- Public Limited Company (PLC)

and some other type of business namely Limited Liability Partnership (LLP), Partnership or Sole Trader.

The most common structure used for international trading is a private company limited by shares. Such company may engage in virtually any legal business, but must obtain licenses for some regulated activities such as banking, insurance, money lending, or investment advice.

The UK does not impose restrictions on foreign ownership or management of companies. It is therefore possible to open a company in the UK for a non-resident. You will not even be required to visit the UK to incorporate your company and can do it from India.

We offer company formations in London and our team, skilled in company formation, international taxation, accounting and immigration services, will be glad to guide you through the process and requirements.

How to set up a limited company? Step by Step process

| First decide the appropriate type of Company | Once you’ve decided to set up a limited company, you have to choose which type you wish to form. The two main choices are: # Private Limited Companies (LTDs) # Public Limited Companies (PLCs) Mostly startups and others prefer a Private Limited Company, as PLCs must have a minimum share capital of £50,000, at least two shareholders, two directors and a qualified company secretary. | |

| Select a name | In general any name can be chosen for a company, provided that the name has not already been registered by another company and provided that the name is not misleading, offensive, or otherwise restricted or forbidden by company law. A company’s name can be changed at any time. It is the company’s registration number, rather than its name, that identifies the company throughout its life. | |

| Choose Directors and a Company Secretary | You must appoint a director but you do not have to appoint a company secretary. Your company must have at least one director. Directors are legally responsible for running the company and making sure company accounts and reports are properly prepared. A director must be 16 or over and not be disqualified from being a director. Directors do not have to live in the UK but companies must have a UK registered office address. Directors’ names and personal information are publicly available from Companies House. Directors must provide a service address (or ‘correspondence’ address), which will also be publicly available. If they use their home address, they can ask Companies House to remove it from the register. You do not need a company secretary for a private limited company. Some companies use them to take on some of the director’s responsibilities. The company secretary can be a director but cannot be: # the company’s auditor # an ‘undischarged bankrupt’ – unless they have permission from the court. Even if you have a company secretary, the directors are legally responsible for the company. | |

| Decide who the shareholders or guarantors are | You need at least one shareholder or guarantor, who can be a director. And Identify people with significant control (PSC) over your company |

| Prepare MOA & AOA | You need to prepare a ‘memorandum of association’ and ‘articles of association’. | |

| Directors/Shareholders Documents | ID and Address proof documents ( Passport/Utility Bill, etc) |

Registered office address A company’s registered office address is its legal headquarters and every UK registered company must have one registered office address. This address is used for all the government’s official correspondence with your company, as well as for storing your company registers ready for inspections.

Following are some rules surrounding the type of address you can use, including:

1) It should be in the jurisdiction (England and Wales, Scotland or Northern Ireland) in which you are forming your company. Whilst you are free to change your registered office at any point after company formation, you cannot change the jurisdiction which your company has been registered in.

2) You cannot use a PO Box number or DX number

3) It should be a physical address.A Service address All company directors, subscribers, secretaries, PSC and LLP members need to give a service address while setting up a company. It is the official contact address when Companies House or HMRC need to contact you.

Rules applied to a service address is:

1) It should be a physical address

2) It can be anywhere in the UK or overseas

3) You cannot use a PO Box number or DX number

4) Your service address and registered office address can be the same

5) You are only eligible to use one service address at a time, however, you are allowed to change your service address at any time.File Incorporation Papers to Companies House You’ll need to register an official address and choose a SIC code – this identifies what your company does.

Companies House is responsible for all limited company registration in the UK. Their website provides detailed information. The following documents must be completed and file with Companies House in order to complete the incorporation process.

1) Memorandum of Association – limited company name, location, business type

2) Form 10 – director’s names, addresses and registered limited company address (this doesn’t have to be where you work from but will be where the legal correspondence from HMRC and Companies House is sent)

3) Form 12 – states the limited company complies with the terms and conditions of the Companies Act

4) Articles of Association – outlines director’s powers, shareholder rights etc. (this is often provided by the formations company that sets up the limited company).

Most people can register for Corporation Tax at the same time as registering with Companies House.

If you cannot, register separately with HM Revenue and Customs (HMRC) after you’ve registered your company with Companies House.

UK govt company regn https://www.gov.uk/set-up-limited-company

Taxation in UK

Value-Added Tax (VAT)

VAT in the United Kingdom is levied in accordance with the Value Added Tax Act 1994 and COUNCIL DIRECTIVE 2006/112/EC of 28 November 2006 “On the common system of value added tax”.

VAT is applied to most of import transactions, sales of goods and provision of services. The standard rate is 20%. Some types of goods are taxed at the rate of 5% or are exempt from VAT.

To work with VAT you need to register with HMRC.

VAT registration is mandatory if:

- your VAT taxable turnover is more than £85,000 over the last 12 months, or

- you realize that your total VAT taxable turnover is going to be more than £85,000 in the next 30-day period.

- Your company purchases goods for more than £85,000 from EU VAT-registered suppliers, or

- If neither you nor your business is based in the UK, then you must register as soon as you supply any goods and services to the UK (or if you expect to in the next 30 days).

You can register voluntarily if your business turnover is below £85,000. You must pay HMRC any VAT you owe from the date they register you.

CORPORATE TAXATION

After incorporation, a UK company shall have statutory tax obligations.

All companies, regardless of size, shall pay the same rate of corporation tax, which is 19%. It is proposed that this rate will fall to 17% starting from the 1st of April 2020.

Dividends (and distributed profit) paid by a company are typically exempt from taxes.

Interest: Interest paid to a non-resident is subject to withholding tax at a 20% rate, unless the rate is reduced pursuant to a tax treaty or the interest is exempt under the EU Interest & Royalties Directive. Reduction under a tax treaty is not automatic and advance clearance must be granted by HMRC.

License payments (Royalties): Royalties paid to a non-resident are subject to withholding tax at a 20% rate, unless the rate is reduced pursuant to a tax treaty or the royalties are exempt under the EU Interest & Royalties Directive. Advance clearance is not required to apply a reduced treaty rate.

There are highly competitive benefits and reliefs for innovative and high-tech industries and businesses dealing with intellectual property, such as tax deductions for qualifying R&D expenditures, lower rate of Corporation Tax to profits earned from patented inventions and certain other innovations (Patent Box) etc.

However, in view of Brexit taking place on the 29th March 2019 we recommend to get updated information on taxes because if the UK leaves the EU without a deal, the way that interest, royalties and dividends are paid between UK and EU companies may change.

Double Taxation Treaties

The United Kingdom has agreements for avoidance of double taxation with more than 100 countries (including India and USA). Despite that, you will not be able to use such agreements if the UK company is nominal, i.e. if it is an agent of another company in a tax-free jurisdiction that receives the most of income. Thus, there is no point in UK company creation only for the sake of application of a tax treaty.

It is also necessary to have economic substance in the territory of the United Kingdom, i.e. to have a real office and manage the company’s affairs from the territory of the UK etc. The company may use international tax agreements only if the income is considered as the income of the UK company. It is not possible to use tax agreements if the company files so-called “dormant accounts”.

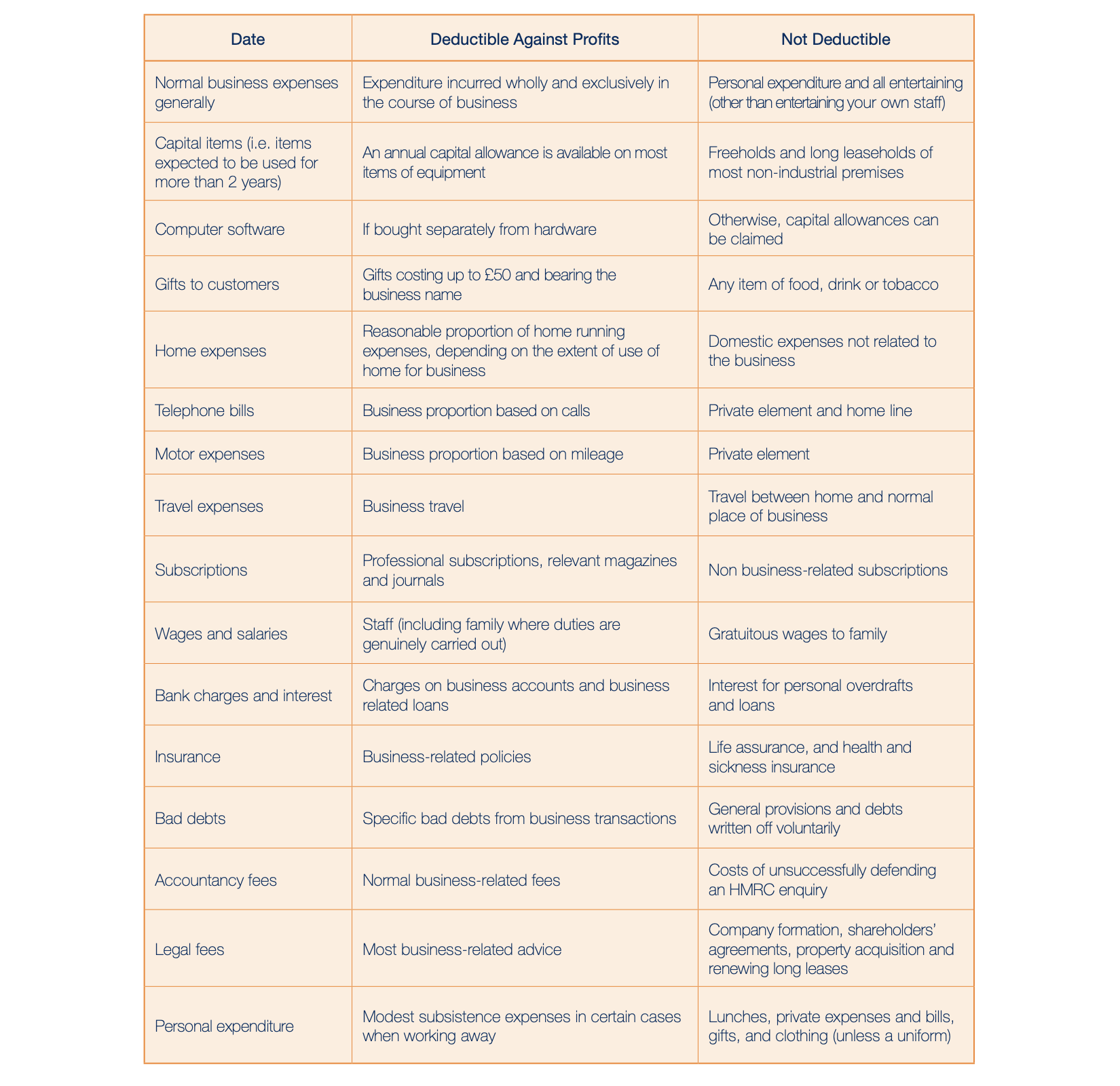

TAX DEDUCTIBLE EXPENSES

The following table shows which items of business expenditure are deductible against a company’s profits for UK corporation tax purposes, and which are not. The list is written in general terms, so specific advice should always be taken.

Personal income Tax

An individual is tax resident in the UK if he or she spends at least 183 days in a year within the country or his or her only home is in the UK for at least 91 days in a year or work full-time in the UK or fulfills one of the previous conditions during the three preceding years.

If the individual is resident but not domiciled (permanent home) in the UK, his or her investment income and capital gains will be only taxed if are remitted to the UK.

Personal income tax rates are progressive up to 45% on income exceeding GBP 150,000. Dividends are also taxed at progressive rates (7.5%, 32.5% and 38.1%) with an allowance of GBP 5,000.

Interest income is taxable as ordinary income, but a 0% may apply to the first GBP 5,000. Rental income is taxed depending on the location of the property.

Capital gains are taxed separately. The first GBP 11,700 may be tax-exempt. Gains exceeding this amount up to 34,500 may be taxed at 10% and 20% on the excess.

Labor Taxes

Employers and employees are required to make contributions to the National Insurance at 13.8% and 12%, respectively, on employees’ income above GBP 157 per week. Businesses may be exempt from the first GBP 3,000 per year.

Tax credits and Incentives

A tax credit for foreign tax paid is usually available, either under a tax treaty or through the unliteral relief rules.

There are several tax incentives for companies in the form of enhanced tax depreciation allowances.

There is also usually available an annual investment allowance of 100% on the first GBP 200,000 per year of capital expenditure incurred.

SMEs may claim a deduction equal to 230% of the qualifying expenditure on R&D in the year in which it is incurred, which can be surrendered for a cash payment (at a rate of GBP 33.35 for each GBP 100 of qualifying R&D spend) by companies that are trading at a loss or have not yet started to trade.

If taxable profits can be attributed to the exploitation of patents, a lower effective tax rate of 10% may apply. Profits may include a significant part of the trading profit from the sales of a product that includes a patent, not just income from patent royalties.

Legal Requirement and compliances in Mauritius Companies

A PLC, however, has a minimum share capital of £50,000, of which 25% must be paid up. So effectively, the minimum share capital for a plc is £12,500. Nearly all start-up companies in the UK are private companies, so you can probably ignore the share capital requirement.

Shares can come in various shapes and sizes. For example, they can be ‘voting’ or ‘non-voting’, ‘ordinary’ or ‘preference’, and ‘redeemable’ or ‘non-redeemable’. A company can also have multiple classes of ordinary shares, for example ‘A’, ‘B’, ‘C’ or ‘D’ shares, which can be useful in some circumstances.

Generally though, most companies are set up with £1 ordinary shares only. We will be pleased to advise on the share structure.

A PLC must have at least two directors. Full details of the legal obligations placed on company directors are available from Companies House www.companieshouse.gov.uk

to which Companies House and HM Revenue & Customs will send

correspondence. The registered office can be changed at any time.

The first accounts should be submitted within 21 months from the date of registration with Companies House. Subsequent accounts should be filed within 9 months after the end of each financial year.

Untimely submission of accounts may lead to high penalties. Failure to provide such documents is considered as a criminal offence. All the company’s directors may be prosecuted.

# Its turnover exceeds £10.2m and it has more than 50 employees, or

# Its turnover exceeds £10.2m and its assets exceed £5.1m, or

# Its assets exceed £5.1m and it has more than 50 employees, or

# It is a plc, or

# Shareholders holding at least 10% between them request an audit, or

# The company is part of a group which exceeds set limits. Auditors, when appointed, are responsible for reporting on whether the company’s accounts are prepared in accordance with UK accounting standards and whether they comply with the Companies Act 2006.

An alternative is for shareholders, who for this purpose do not need to be a director or employee of the company, to take a dividend. A dividend, unlike a salary, comes out of the company’s post-tax profits and therefore does not reduce the company’s tax liability. It can in some cases be more tax-efficient than a salary because there is no employee’s or employer’s NI on a dividend, and because there is a dividend allowance that can make a dividend tax-free up to a certain point.

A) Accounts:- A company’s annual accounts must be filed at Companies House. For most private companies, other than those above a certain size, less detailed accounts can be filed, rather than fuller accounts, although it is still necessary to have fuller accounts prepared for the tax authorities.

B) Confirmation Statement:- Every company must submit a Confirmation Statement to Companies House annually. Although it is the responsibility of the company’s directors (and the company secretary, if there is one) to deal with company secretarial matters, Glazers handles the Confirmation Statement on behalf of most of our clients. The form is normally filed electronically at Companies House.

C) Notifying Changes:- There are numerous forms for notifying Companies House of changes that may take place from time to time, such as appointment of directors, termination of directors, changes in address for the company or directors, share issues and changes relating to “People With Significant Control.”

A) Corporation Tax Return and Accounts – The corporation tax return is prepared using the figures in the company’s accounts, and filed electronically at HMRC each year, together with a copy of the full accounts.

B) VAT Returns – Companies that are registered for VAT need to file VAT returns with HMRC. These are most commonly filed every three months, though a company can opt to file these monthly or annually, which is appropriate in certain cases.

C) PAYE and NI Returns – PAYE is a system of deducting tax payments from salaries paid by an employer to its directors and employees. Any company that operates a payroll must file monthly PAYE returns. These returns also include NI contributions.

D) P11D Forms – As mentioned earlier in this guide, companies that provide benefits in kind, or reimburse expenses to its directors or employees, are required to report these details to HMRC each year.

A) Payroll, PAYE and National Insurance – You will need to deduct Pay as you Earn (PAYE) and National Insurance (NI) from your employees’ salaries or wages, and pay this over to HM Revenue & Customs. PAYE is a deduction of income tax. NI is the equivalent of what is known as social security in many countries. As the employer, you will be responsible for calculating these amounts and you will need to keep tax deduction records for everybody that you employ. You will also be liable to pay employer’s NI contributions.

B) Employment Law – Limited companies have the following obligations as employers: –

# Employer’s liability insurance is compulsory by law if the company employs anyone. It covers personal injury and damage to personal property of employees.

# The company needs to comply with UK Health and Safety legislation.

# Employment contracts are generally a legal requirement once an employee starts work.

C) Tax Concessions for Employees – While employees from overseas are usually liable to UK tax and national insurance on their salary and benefits in the UK in the same way as UK nationals, certain concessions are available where an employee of an overseas company has been seconded to the UK for up to two years. This allows the employer to provide accommodation, travel and other similar benefits tax-free. There are also certain concessions for employees serving longer in the UK, entitling them to tax relief on travel.

D) Staff Pension Schemes – Subject to certain exemptions, employers in the UK must set up a workplace pension scheme for its employees.

E) P11D Forms – If a company provides benefits in kind to any of its directors or employees, (such as a company car, private health insurance, etc.) or reimburses a director or member of staff for company expenses that they have paid for personally, then the company is required to file an annual P11D form for that director or employee.

change of directors or their personal details;

# change of the registered office address;

# information regarding the capital (statement of capital);

# change of the main type of activity;

# information regarding the shareholders (included in the register of the company’s members). Number of their shares, details of transfer of such shares;

# information on the company’s decision to keep a PSC Register information on the public register;

# information regarding the persons having significant control (PSC), if the company decided not to keep such information on the public register.

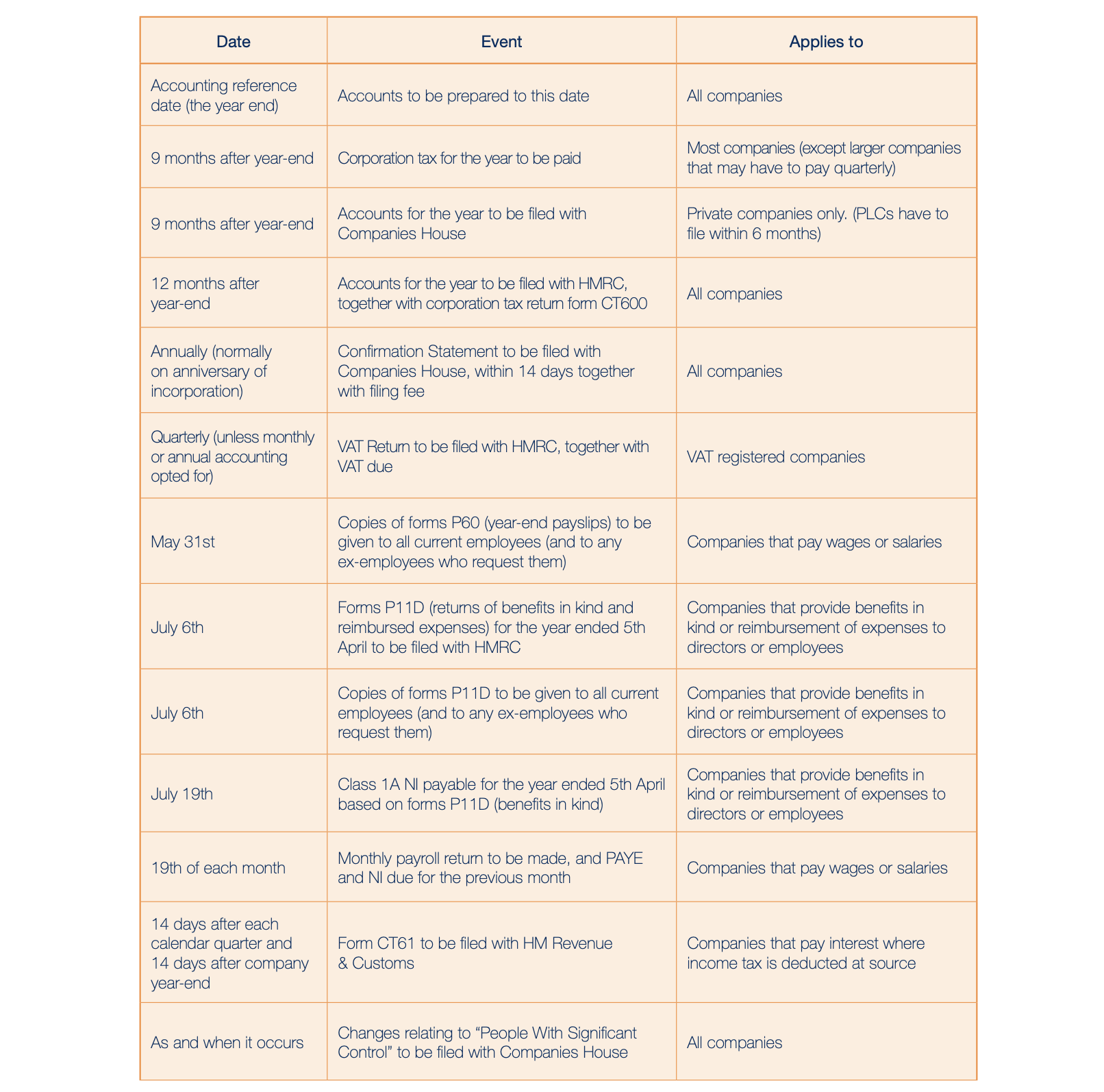

IMPORTANT COMPLIANCES AND DUE DATE IN UK FOR COMPANIES

COMPLIANCE CALENDAR

The following table contains a summary of the dates and time limits for filing documents and paying tax. The list is written in general terms, so specific advice should always be taken.