Company Incorporation in USA

Company Incorporation in United States of America (USA) for a Non Residents

Primary Requirement for a Private Limited Company in US

- A Foreigner can choose Either LLC or C-Coporation

- Best State to register is Delaware for Non Residents

- Hire a Registered Agent recognized by the State of Delaware

- Minimum one Director and shareholder | No requirement of Minimum Share capital

- Not Mandatory of Local Secretary

- Obtaon EIN (Employer Indentification Number)

Why USA is best choice for Business? Which state is better?

Many international entrepreneurs are looking to create or expand their business into the U.S. market. US is the world No.1 Business hub and US Marketplace is the key to success for any business around the world. The USA has proven as the world largest, best and integrated market with and lowest tax rate. A non-resident can easily form a company in US and it is 100% Online process.

Now the question is Which state to choice for registration?

If your business has no physical connection to any specific state it is recommended to form your company in one of the incorporation-friendly states, such as Delaware, Wyoming, or Nevada.

Delaware is one of the world’s most popular jurisdictions to incorporate a company. Nearly half of US publicly traded companies and more than 65 percent of all Fortune 500 companies are incorporated in Delaware. Including giants such as Apple, Coca-Cola, Google, and Wal-Mart.

The legal and liability protection of established corporate laws in Delaware makes the jurisdiction one of the most reputable business-friendly states.

The State of Delaware has also an attractive tax regime. Delaware corporations doing business exclusively outside of the State are exempt from State tax. Furthermore, there is no inheritance tax on stock held by non-Delaware residents, no state sales tax on intangible personal property and share of stock owned by non-residents are not subject to Delaware taxes.

Companies incorporated in Delaware are confidential. Details of shareholders, directors, and officers are not disclosed in the company formation documents and are not available to the public.

Delaware corporations are flexible structures, the same person may be the sole shareholder, the director, and the officer.

In addition, it has one of the quickest company registration procedures and lowest costs of incorporations in all United States.

Delaware is an excellent jurisdiction for startups and companies seeking financing. Venture capitalists, angel investors, investments banks and other investors prefer Delaware corporations above all other states and corporate structures.

4 Different Type of Companies in US

General Corporation (C Corporation) A General Corporation (or “C Corporation”) is the most common corporate structure for medium and large companies. Characteristics include:

# Unlimited Number of Shareholders

# Separate Legal Entity

# Taxation of Profits and Losses at the Corporate Level

# Possibility to Raise Capital with Sale of Shares

# Easy Transfer of Shares

# Tax Benefits

# No Obligation for the Shareholders or Directors to be U.S. Citizens or Residents.

C Corporation is allowed for foreigners to form in US.Close Corporation A Close Corporation is similar to a C Corporation, except for the following aspects:

# Number of Shareholders Limited to 30

# Transfer of Shares Conditional to Directors’ Prior Approval

# Prohibition to Trade Shares on the Stock ExchangeS Corporation An S Corporation is actually a C Corporation which then obtains a special tax status from the Internal Revenue Service (IRS). The Corporation must apply to obtain this special status within a certain time frame after its incorporation. Instead of being taxed at the Corporation level, the profits and losses are transferred, for tax purposes, to the Shareholders (as though they were partners). Double taxation is avoided (i.e. at the corporate level and at the personal level) and does not alter any of the legal protection offered by a Company.

# Protection of the Shareholders’ Assets

# Profits and Losses of the Corporation Allotted Directly to the Shareholders

# U.S. Citizenship or Residency Required for Shareholders

# Number of Shareholders Limited to 100

# Only One Class of Shares

# Other Restrictions ApplicableLimited Liability Company (LLC) Introduced in the United States by the State of Wyoming in 1977 and now recognized by all U.S. States, the Limited Liability Company (LLC) is a profitable mix of a Corporation and a Partnership. As a general rule, the revenues and losses of an LLC are allotted to its Members (the equivalent of Shareholders in a Corporation), which avoids double taxation (to the LLC and its Members). This type of Company resembles the S Corporation, but without the restrictions attached to the latter. The advantages of an LLC are as follows:

# Absence of taxation at the corporative level, except if this tax option has been specifically requested

# Personal Liability of the Members limited to their investment within the LLC

# Protection of the Members’ Assets

# No Possibility for an LLC Creditor to seize control of the LLC’s assets, nor Member’s voting rights

# Profits and losses of the LLC allotted directly to the Members, in the proportion determined by them

# Unlimited number of Members

# Flexibility to organize the LLC

# Elimination of the usual corporative formalities (e.g. Minutes, Bylaws, meetings, Officers and Directors, etc.) if specified in the LLC Operating Agreement

# Drafting of LLC Operating Agreement in any language (no obligation to write or translate into English)

# No Obligation for the Members or Managers to be U.S. Citizens or Residents.

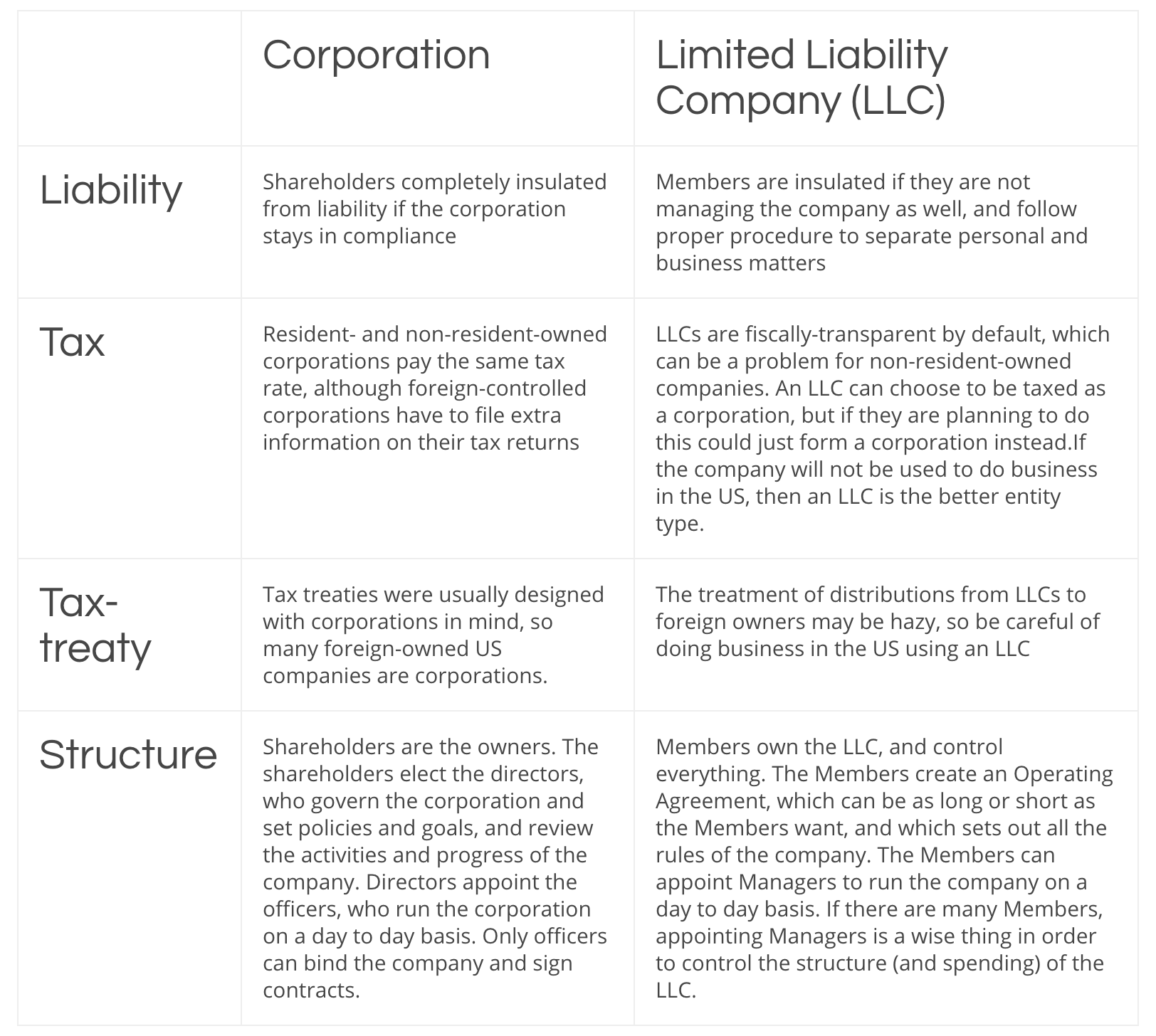

Understand Difference between “Corporation” OR a “Limited Liability Company”

WHETHER TO BE A CORPORATION OR A LIMITED LIABILITY COMPANY?

There are two main types of US business entities: the business corporation (company limited by shares) and the limited liability company, or LLC.

For a non-US resident forming a new company, it is critical to understand the differences between the types of US business entities. Business entities are always formed under state law instead of federal law. Because each state makes its own laws, the specific rules and requirements are different from state to state. A business entity is automatically entitled to do business in the state where it is formed, but in order to do business in another state, they must register to do business there. The definition of “doing business in a state,” like so many things, is different from one state to another, but there are common themes to be aware of.

Each state has its own register of names. When creating a new company, the proposed name of the company is only checked in that state. Therefore, a company name is only protected in the state where it is incorporated and in any state in which it is registered to do business.

Legal Requirement and compliances in US

Corporations may be formed by one or more shareholders, who can be either natural or legal persons, residents or non-residents, without limitations. The identity and personal information of the stockholders are not publicly disclosed.

Directors of publicly traded companies must meet certain requirements including, in certain circumstances, the requirement to be independent (that is, not to have a material relationship with the company or its management).

If the Corporation is physically located in Delaware, it may act as its own registered agent. A registered agent may be either an individual resident or business entity that is authorized to do business in Delaware. The registered agent must have a physical street address in Delaware.

Delaware does not require corporations to file any financial reports, corporations are not required to appoint an auditor and file financial statements audited.

Delaware corporations must file an annual franchise tax report and pay an annual corporate franchise tax up to a maximum of US$180,000. The tax is assessed based on the number of shares authorized by the company using either the authorized shares method of computation or the assumed par value capital method.

All annual franchise tax reports must be filed electronically on or before 1 March, and payment is accepted only in US dollars and drawn on US banks.

The Delaware Code requires that a corporation’s annual report be signed by a director or officer. Failure to file a complete annual report and/or pay annual franchise taxes can result in the corporation being voided.

Every domestic or foreign corporation doing business in Delaware that is not specifically exempt must file a Delaware corporate income tax return and a gross receipts tax return. Corporations whose activities are limited to maintaining a statutory registered office and not conducting business within Delaware, may be exempt from filing the Delaware Corporate Income Tax Return.

Delaware corporations are also required to file Federal Income tax returns. US Entities with 25% or more ownership by a foreign shareholder may be required to file IRS Form 5472 “Information Return of Foreign-Owned US Corporation or Foreign Corporation Engaged in a US Trade or Business”.